Property Tax

Due Dates

- Property taxes may be paid in full in September each year or split into two installments:

- The first half is due September 1 and becomes delinquent October 1;

- The second half is due March 1 of the following year and becomes delinquent April 1;

Delinquent parcels are assessed an interest penalty that accrues each month the parcel remains delinquent.

Payment Methods

- In office with cash, check, debit card or credit card (credit cards accepted for an additional fee)

- Online

Pay your property taxes online with an eCheck for only .25 cents (which is less than a postage stamp!) or you can pay in-office with a debit for no fee or a credit card for 2.25% of the total amount due.

Accepted Credit Cards (cards accepted for an additional fee)

- MasterCard

- Visa

- Discover

Scheduled Payments

Cerro Gordo County allows scheduled payments of currents property taxes. Visit our office to set up automatic payments from your bank account.

Notice of Delinquent Taxes

The law requires:

- A notice will be sent to property owners who have outstanding taxes as of November 1 and May 1.

- A notice of the annual tax sale shall be mailed no later than May 1 to the person in whose name the parcel subject to sale is taxed

- Payments for redemption from tax sales must be paid by guaranteed funds. The rate of interest required by Iowa law to be paid on a redemption is 2% per month.

Delinquent taxes won’t be advertised in the paper until June 1st, but the publication fee goes on May 1st no matter what.

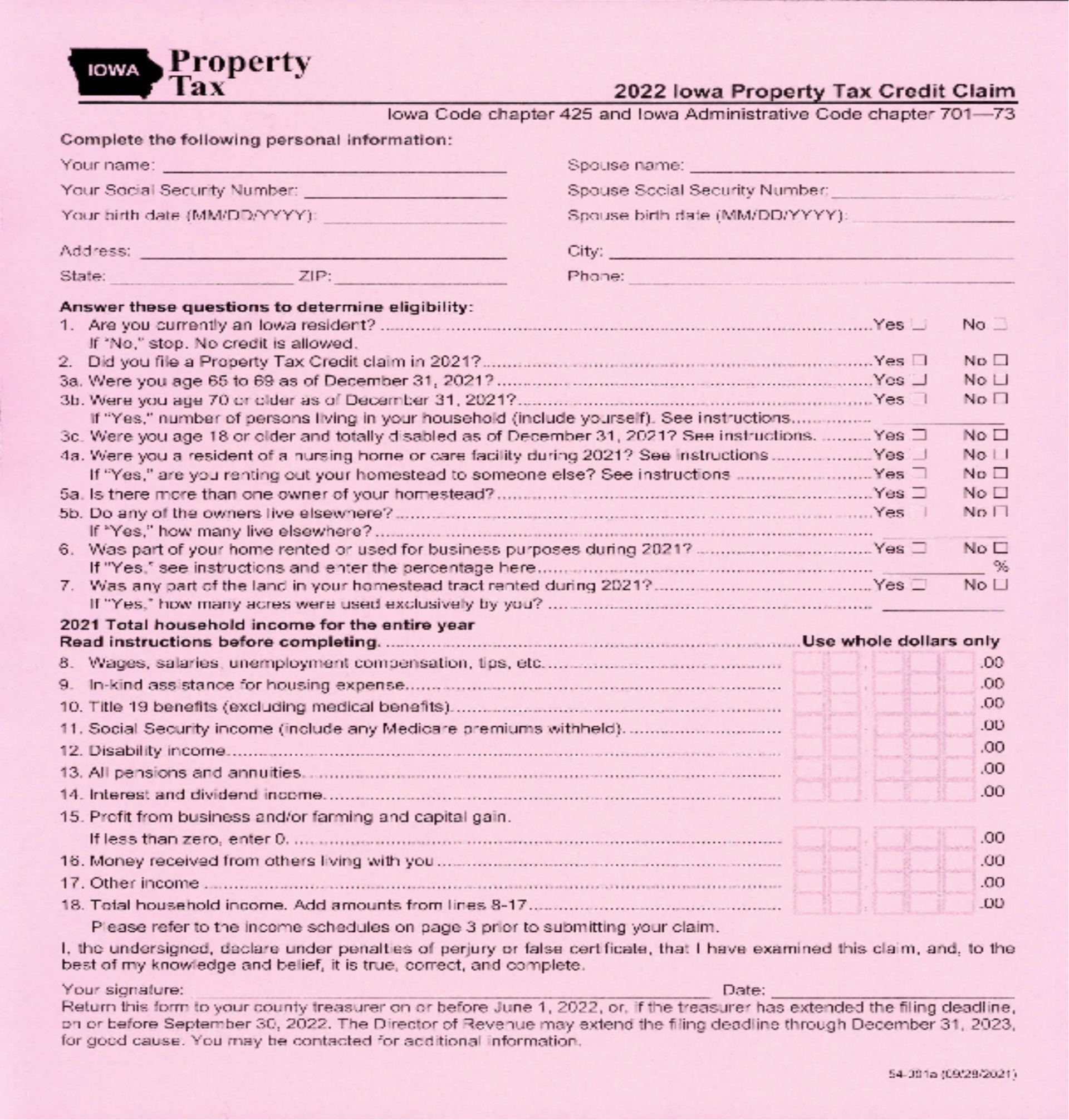

Property Tax Credits

- Elderly and Disabled Tax Credit:

*** Important: Claimants of the elderly and disabled credit MUST file a claim EACH year in order to receive the (maximum) benefit of the tax credit.***

- The Iowa legislature allows a property tax credit based on total household income for residents of Iowa, aged 65 and older, or age 18 and older and totally disabled.

- The income is based on last years income. The total household income for 2023 must be less than $25,328.

- The income requirements change annually. Claimants can receive a maximum tax credit up to $1000.

- To file for this credit, complete and return this form to the office: 2024 Iowa Property Tax Credit Claim form.

- It must be returned to the office before June 1st.

Over age 70: Those age 70 or older who don't qualify under the above listed amount may still qualify for a property tax credit. Those over age 70 can apply based on the federal poverty level guidelines as set by the Department of Revenue. The income guidelines are slightly higher than the 65+ credit, but it does work differenlty than the traditional credit. The 70+ tax credit acts as a "freeze" on the assessed property value once the base is established and other credits are taken into consideration. The first year a household qualifies will act as the base amount for the property tax freeze. Below are the income guidelines for this category:

| 2023 Household Income Guidelines for Persons Age 70 and Over |

|

|---|---|

| If number of persons in family/household is: | and total household income is less than: |

| 1 | $36,450 |

| 2 | $49,300 |

| 3 | $62,150 |

| 4 | $75,000 |

| 5 | $87,850 |

| 6 | $100,700 |

| 7 | $113,550 |

| 8 | $126,400 |

| For families/household with more than 8 persons, add $12,850 for each additional person. | |

- Mobile /Manufactured Home Reduced Tax Rate:

- The Iowa legislature allows a property tax credit based on total household income for residents of Iowa, aged 23 and older, or age 18 and older and totally disabled. Iowa Resident as of December 31, 2023.

- Total 2023 household income must be less than $25,328.

- Rented the property during any part of 2023.

- Military Exemptions, Homestead Credits, and Tax Abatements:

- Military exemptions, homestead credits, and tax abatements are administered by the Cerro Gordo County Assessor's Office. Contact the Assessor's page or office for further assistance.

New: 65+ Homestead Tax Exemption

House File 718 was signed into law on May 4, 2023, which establishes a homestead tax exemption for claimants 65 years of age or older.

Eligible claimants who own the home they live in and are 65 years of age or older are eligible. The deadline to apply is July 1, 2023, and will take effect on the property taxes due in September 2024. For the assessment year beginning on January 1, 2023, the exemption is for $3,250 of taxable value. For assessment years beginning on or after January 1, 2024, the exemption is for $6,500 of taxable value. Note: an exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax you pay. The application can be found on the Iowa Tax website or by visiting or calling the Cerro Gordo County Assessor’s Office. If the exemption is granted, the exemption will be allowed for future years without future filing as long as the claimant continues to qualify. IMPORTANT: You MUST complete an application to receive this exemption....even if you already have an application for the homestead credit on file.